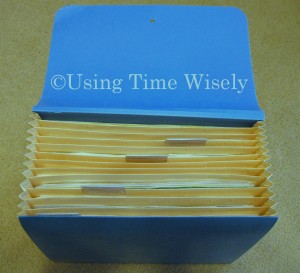

Having completed the first two categories: Credit Report/Card Documents and Important Personal Documents in our filing system, it is time to focus on the third category: Home Ownership Documents. Since the first two categories took up file slots one through seven, the home ownership documents begin in the eighth slot in my accordion filing system (pictured).

Having completed the first two categories: Credit Report/Card Documents and Important Personal Documents in our filing system, it is time to focus on the third category: Home Ownership Documents. Since the first two categories took up file slots one through seven, the home ownership documents begin in the eighth slot in my accordion filing system (pictured).

In case you are thinking, “I don’t own a home, so I can skip this section,” hang in there. When I setup our filing system, Paul and I were living in a rented townhouse. Though we did not own a home, we still had documents housed in this category. Then when we built and purchase our first house (about 1.5 years later), I knew exactly what documents I needed to keep and where to place them. So, hang in there through this category. If you plan to own a home at some point in your future, then this section can help you prepare for that day.

Here is the checklist from the Protection Portfolio system by Suze Orman:

- Deeds

- Promissory Notes*

- Homeowner’s insurance

- Co-ownership property agreement*

- Fire insurance

- Copy of survey

- Copy of title policy

- Appraisals and evaluations of valuable items such as jewelry, art, and antiques

Items with an (*) are additional records Suze Orman suggests for this category that I do not have in my file.

Having researched mortgages and purchased one home, I will share with you my experiences. In no way am I offering advice or suggesting that you follow the path Paul and I have trod. If you are looking for information on mortgages, insurance, or other items dealing with home ownership, then please consult a highly recommended professional in the field.

Located in this eighth file slot under Home Ownership, I have the following 4 documents paper clipped together:

1. Recorded Deed. To the best of my knowledge, this document was sent to me from the Register of Deeds about a week after our closing. Our deed is an original 2-page document.

2. HUD Settlement Statement for Mortgage. The U.S. Department of Housing and Urban Development (HUD) requires this standardized form for federally related mortgages and is a financial overview of our closing. This 4-page document included the sale price, sellers’ costs, buyers’ costs, and all payments. I consider this document my receipt for our mortgage.

3. HUD Settlement Statement for Line of Credit. This document is a 3-page receipt for our line of credit account.

Though you may or may not agree with our choice for home mortgage, we did a lot of research before building and purchasing our home. Our best option was an 80/20 loan. We chose a mortgage to cover 80% of our contract price, and a 20% line of credit to cover the remaining balance.

By splitting the amount into two loans, we avoided paying PMI (private mortgage insurance) which is insurance for the lender and cannot be claimed on taxes. This choice has and continues to work well for us, and I have no buyer’s remorse.

4. Copy of check and receipt from attorney’s office. At our closing, we were refunded for our escrow amount. When Paul and I contracted with our builder, we paid a lump sum up front. Then about 5-6 months later at our closing, we received a check for the balance in that account. In this file slot, I keep the copy of the check with the receipt.

Since Paul and I only own one home, our filing system holds one set of these documents. If you own multiple properties or homes, then you will want to keep separate file slots for each property. If you have many properties, then another accordion file or system may be in your future. 🙂

This set of documents is housed in the eighth file slot of my accordion filing system under the third category: Home Ownership Documents. The next item in Suze Orman’s checklist is Promissory Notes. Since I keep another filing system for our home documents, I do not have our promissory notes or mortgage and line of credit paperwork in this filing system. Therefore, I am not going to write a separate post for them. If you do not have a “home” for your promissory notes and closing documents, you might consider housing them in this file.

Though I will not post about promissory notes next week, I will share my homeowner insurance documents housed in this category. I hope you are successfully organizing your important documents to help you use your time wisely for years to come. Happy organizing!