Knowing that a successful year will not materialize on its own, we must plan and prepare for a prosperous 2013.

Throughout the 31 days of January, I will choose one topic each day to prepare or schedule for this year.

Without preparation, I know I will forget, miss, or overlook certain items. If you desire an organized year, then join me in this adventure of Planning for Success for a prosperous 2013.

To receive a daily e-mail around 11:00 a.m. with the new posts of each day, subscribe to my free daily newsletter. In case you miss a post in this series, I will provide the link to each day as the month progresses. 🙂

- Day 1: Select a Planning Tool

- Day 2: Add Your Priorities

- Day 3: Print and Display Your Menu Planner – with free printable

- Day 4: Record Membership Expiration Dates

- Day 5: Mark Due Dates for Monthly Bills

- Day 6: Insert Credit Report Schedule

- Day 7: Schedule Your Annual Home Maintenance

- Day 8: Set Your School and Work Activities

- Day 9: Highlight Contract and Subscription Expiration Dates

- Day 10: Download a Savings Tracker

- Day 11: Note Daily Deals Expiration Dates

- Day 12: Setup Bill Pay

- Day 13: Secure Doctor Appointments

- Day 14: Purchase Batteries

- Day 15: Include Holidays

- Day 16: Jot down Library Return Dates

- Day 17: Track Your Family’s Favorite Meals

- Day 18: Reserve Time for Your Priorities

- Day 19: Post Your Payday Schedule – with free printable

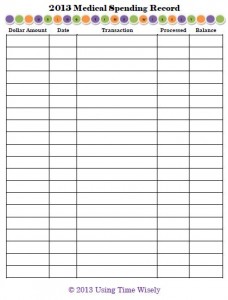

Day 20: Prepare Your Medical Spending Record

Keeping the paperwork under control is an ongoing battle. Between the mail and on-line statements, the documenting and checking this information continues.

One set of documents that comes monthly is our medical spending statement. Having explained in detail the benefits of a medical spending account or a health savings account, I advised Paul to enroll again for 2013 which he did. 🙂

Having determined approximately how much we plan to spend in medical expenses for 2013 at our open enrollment session, we signed up and received confirmation of the changes from 2012. Taking that information and verifying against our request, I recorded the information on my Medical Spending Record.

Free Printable

Portrait Options

2013 Medical Spending Record (.pdf version)

2013 Medical Spending Record (Microsoft Word version)

Landscape Options

2013 Medical Spending Record (.pdf version)

2013 Medical Spending Record (Microsoft Word version)

You are welcome to download, customize the Microsoft Word version, and use this free printable. To share this resource with others, please forward the link to this post rather than sending the file directly.

Thank you for protecting Using Time Wisely’s copyright.

With 5 columns, I record the dollar amount, date, transaction, date processed, and balance.

1. Dollar amount: The amount spent or deposited.

2. Date: The date of service.

3. Transaction: Description of payment (e.g., Tracy’s doctor’s visit, Paul’s prescription, Tracy’s contacts, etc.).

4. Date Processed: The date the transaction cleared your account.

5. Balance: Total amount left to spend for 2013.

By recording our medical payments to our Medical Spending Record, I can quickly verify the information when the statements arrive and know our balance left to spend.

For those of you using a Health Savings Account (HSA), your financial institution should provide a saving register for your information. With your HSA, you will have deposits, withdraws, and dividends. As you prepare for 2013, keep your account balanced.

In planning for success, prepare your medical spending record. I have used the Medical Spending Record for a number of years. The simple spreadsheet tracks our expenses and payments, so I am sure to use all these funds for our medical expenses this year.

As you scrimp and save this year, follow your Medical Spending Record to prevent unused medical funds at the end of 2013. Remember, you will lose what you do not spend in this account. The advantage is using pre-taxed dollars for your medical care.

When not in use, file your Medical Spending Record within your insurance file under category Tax-favored Programs. Happy organizing!

Question: How do you prepare for your family’s 2013 medical expenses?