Knowing that a successful year will not materialize on its own, we must plan and prepare for a prosperous 2013.

Throughout the 31 days of January, I will choose one topic each day to prepare or schedule for this year.

Without preparation, I know I will forget, miss, or overlook certain items. If you desire an organized year, then join me in this adventure of Planning for Success for a prosperous 2013.

To receive a daily e-mail around 11:00 a.m. with the new posts of each day, subscribe to my free daily newsletter. In case you miss a post in this series, I will provide the link to each day as the month progresses. 🙂

- Day 1: Select a Planning Tool

- Day 2: Add Your Priorities

- Day 3: Print and Display Your Menu Planner – with free printable

- Day 4: Record Membership Expiration Dates

- Day 5: Mark Due Dates for Monthly Bills

- Day 6: Insert Credit Report Schedule

- Day 7: Schedule Your Annual Home Maintenance

- Day 8: Set Your School and Work Activities

- Day 9: Highlight Contract and Subscription Expiration Dates

- Day 10: Download a Savings Tracker

- Day 11: Note Daily Deals Expiration Dates

- Day 12: Setup Bill Pay

- Day 13: Secure Doctor Appointments

- Day 14: Purchase Batteries

- Day 15: Include Holidays

- Day 16: Jot down Library Return Dates

- Day 17: Track Your Family’s Favorite Meals

- Day 18: Reserve Time for Your Priorities

- Day 19: Post Your Payday Schedule – with free printable

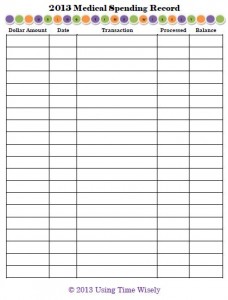

- Day 20: Prepare Your Medical Spending Record – with free printable

- Day 21: Check Light Bulbs and Air Filters

- Day 22: Choose Event Dates

- Day 23: Enter Reward Deadlines

- Day 24: Design a Quick Meals List

- Day 25: Document Family Holidays

- Day 26: Verify Paystub Deductions

Day 27: Establish Automatic Transfers

With all the conveniences of the 21st century, my life should seem easy and relaxed, but it’s not. In saving time using modern technology (i.e. washing machine, microwave, etc.), I don’t use the “extra” time to relax. Instead, I fill those sections with more to do (i.e., cutting coupons, cleaning, organizing, etc.). These other things are necessary, but I miss those lazy days of summer where life trots at a slower pace.

Of course, I feel the crunch of my schedule more this year due to my two older children in school and on difference schedules. Spending 2 hours in the van each day eats up a chunk of my day, but on an upnote, the school year is half over. 🙂

Having resources available to ease my memory and prepare for the future, I learned the value of automatic transfers for direct deposits, savings accounts, and retirement savings. Though we are currently not using all three of these options, Paul and I have used each of these during our 14 years of marriage.

Direct Deposit

Getting our paychecks automatically deposited into our checking account saves time and money. Without picking up the check and taking it to the bank, I can quickly access our account on-line to verify the deposit. The money in the account is available for use immediately, so no waiting is needed.

Stopping by Walmart last Friday was an eye-opening experience. The customer service line was out the door. Then I realized that all these individuals were cashing their payroll checks at a cost of $3 each. Yikes! I can think of other ways to spend that $3, but that choice costs these individuals time and money.

Savings Account

By using direct deposit, our financial institution offers scheduled transfers. Similar to bill pay, the amount you designate transfers from one account to another account on the date you specify. This option is great for increasing your emergency fund and your savings account.

Suggestion: If you desire to increase your savings and need a suggestion to do so, then read How to Save Nearly $1,400 in a Year . . . One Week at a Time, a fantastic post by Pamela from Lawrenceville, Georgia, who contributed on The Krazy Coupon Lady’s website.

She sets a goal, breaks it down into weekly segments, and shows how to execute. I love this simple concept which you can adjust to meet your needs throughout the year.

I like setting a dollar amount to transfer the day after payday from our checking to our savings account. I increase our savings without spending time or forgetting to make the transfer.

Retirement Savings

If you have a retirement account outside of your employer’s plan, you might have the option to setup automatic withdrawals from your financial institution. Vanguard has a short form for investors to authorize transfers. This system works well as you may cancel or change the parameters of the exchange at any time.

In planning for success, establish automatic transfers. With this little convenience, you can grow your accounts without spending your time making each transfer.

If you change your mind, then make adjustments as needed. In using time wisely, automatic transfers won’t take us back to the lazy days of summer, but they can increase our efficiency. Happy relaxing and establishing!

Question: What automatic transfers have you established?