Knowing that a successful year will not materialize on its own, we must plan and prepare for a prosperous 2013.

Throughout the 31 days of January, I will choose one topic each day to prepare or schedule for this year.

Without preparation, I know I will forget, miss, or overlook certain items. If you desire an organized year, then join me in this adventure of Planning for Success for a prosperous 2013.

To receive a daily e-mail around 11:00 a.m. with the new posts of each day, subscribe to my free daily newsletter. In case you miss a post in this series, I will provide the link to each day as the month progresses. 🙂

- Day 1: Select a Planning Tool

- Day 2: Add Your Priorities

- Day 3: Print and Display Your Menu Planner – with free printable

- Day 4: Record Membership Expiration Dates

- Day 5: Mark Due Dates for Monthly Bills

- Day 6: Insert Credit Report Schedule

- Day 7: Schedule Your Annual Home Maintenance

- Day 8: Set Your School and Work Activities

- Day 9: Highlight Contract and Subscription Expiration Dates

- Day 10: Download a Savings Tracker

- Day 11: Note Daily Deals Expiration Dates

- Day 12: Setup Bill Pay

- Day 13: Secure Doctor Appointments

- Day 14: Purchase Batteries

- Day 15: Include Holidays

- Day 16: Jot down Library Return Dates

- Day 17: Track Your Family’s Favorite Meals

- Day 18: Reserve Time for Your Priorities

- Day 19: Post Your Payday Schedule – with free printable

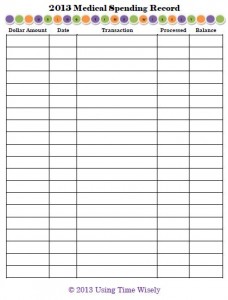

- Day 20: Prepare Your Medical Spending Record – with free printable

Day 21: Check Light Bulbs and Air Filters

This school year has been really tough on so many levels. My time at home during the day is hit or miss, so I must make the most of the mornings I have at home. Without spending an hour just writing out my to-do list, I need to get productive. By jotting notes to myself, using my calendar, and staying motivated, I can maximize my time.

Though my cleaning this year seems to only occur during school breaks, I know that this mess is for a season. To adjust to these changing times, I concentrate on what I can do, and let the rest go. To focus my attention when I can spare a few moments, I include on my calendar a time to check light bulbs and air filters.

Light Bulbs

Keeping light bulbs on-hand in the type and size needed, I check for outages regularly. Finding that working in a well-lit area allows me to think clearly, I like to keep the lights on and the rooms bright. If I find a light out, I either change it or ask Paul to do so. But with a scheduled time, I can note any outages with seldom used lights.

Air Filters

Changing our air filters monthly with basic filters or every 3 months with high-efficiency filters, we keep our air and heating systems running efficiently. The changes to our 3 filters also keeps dust and allergens from recycling back through our home. Since our filters are out of sight, I must schedule the maintenance change to put it on my mind.

In planning for success, add check light bulbs and air filters to your planning tool. For me, the last week of the month seems less hectic than the rest of the month. Taking advantage of the lull in my schedule and using time wisely, I take about 5 minutes to walk through the house checking the lights. For the air filters, I just need to ask Paul, who willingly changes them. 🙂

Though home maintenance is ongoing, investing 5 to 10 minutes a month to check your light bulbs and air filters allows your family to see and breathe easier. As you complete these small tasks, you might get motivated to make larger changes. Happy maintaining!

Question: How often do you check light bulbs and air filters?