Document organization takes time and energy. Having recently purged our tax boxes, I ended up with two 20-gallon totes full of paperwork to shred. Now, I had let our tax documents pile up, so I still had records from 2007. (I said it had been awhile. :-)) It was so nice to rid our home of all that outdated paperwork.

Document organization takes time and energy. Having recently purged our tax boxes, I ended up with two 20-gallon totes full of paperwork to shred. Now, I had let our tax documents pile up, so I still had records from 2007. (I said it had been awhile. :-)) It was so nice to rid our home of all that outdated paperwork.

In choosing what to keep and what to toss, I made my decisions based on what I needed. The Internal Revenue Service (IRS) typically has 3 years to audit a tax return and 10 years to collect taxes. Since our taxes have been paid each year, I keep 3 years worth of records.

These records are all the statements, payments, contribution records, donation receipts, interest notices, tax forms, and other documents needed to file our taxes for that year. Should the IRS choose to audit our tax returns, I will have all the records available to prove the amounts entered for each line item.

In addition to 3 years of records, I also keep every tax return we file with the W-2 forms. My reasoning is to prove our Social Security benefits should the Social Security Administration change the laws or lose our information.

Keeping the hard copies of the records is for my peace of mind. These small packets do not take up much space, and I cannot recreate these documents should I need them in the future.

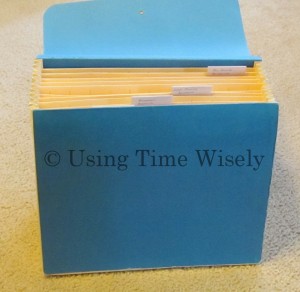

Now, I house all those records in 20-gallon totes. In our important documents file, I keep the current 3 years of tax returns. The last post was focused on our 2012 tax documents. Today, I will share the records kept for our 2011 tax documents.

2011 Tax Documents

Located in the 11th file opening of File Box 3, the first bundle of paperwork is our 2012 tax documents. The second bundle consists of these 2011 tax documents:

Federal Tax Documents

- Copy of tax refund check

- Federal Income Tax Return with Schedules and Worksheet

State Tax Documents

- Copy of tax refund check

- State Income Tax Return

Electronic Filing Documents

- TaxAct Declaration

- TaxAct Filing Instructions for Federal and State

- TaxAct Status Report

- TaxAct Confirmations

- TaxAct locked in price for 2012 at a discounted price

Each of these sections is either stapled or paper clipped together and then one large paper clip combines all three sections into one bundle. This bundle is the second of three years kept within this file opening of our tax records category.

Keeping the records in two places might cause more confusion than order. If so, then do what is best for you. For me, I sometimes need to know what our gross annual income was for a particular year. By having those records in our important document file within easy reach at my desk, I can quickly locate that information. If I had the records in the totes, then I would need to go to storage to get them.

I share my system as an example of what is working for me. Finding a system that saves you time and energy is the key. Keep on organizing those important documents as we tackle those piles of paperwork. Happy organizing!

Question: Do you keep your tax documents in one location or in multiple locations?